C_S4FTR_2021 -Treasury with SAP S/4HANA Certification dumps

Prepare effectively for your certification exam with our latest SAP C_S4FTR_2021 PDF questions and answers. This comprehensive resource features real exam questions along with clear and detailed explanations, making it easier to understand Treasury with SAP S/4HANA concepts. Our verified C_S4FTR_2021 exam dumps are designed to reflect the actual SAP exam structure and cover all essential topics. With these up-to-date materials, you can streamline your study process, focus on what matters most, and approach the SAP C_S4FTR_2021 certification exam with confidence—maximizing your chances of success on the first attempt.

We offers exact Questions from an actual Exam.

Guaranteed Success in the first attempt.

We'll give you all your money back.

No questions asked.

All orders are Delivered instantly.

Once you will buy any of our products you will be subscribed to free updates for up to 90 days.

We Offers you 24/7 free customer support to make your learning smooth.

$69.00 $100.00

Hurry Up! Offer ends in:

C_S4FTR_2021 – Treasury with SAP S/4HANA Certification

Exam Details:

- Level: Associate

- Exam: 80 questions

- Delivery Methods: SAP Certification for Exam Preparation (PDF Format)

What This Certification Covers

The SAP C_S4FTR_2021 certification proves you have the basic and core skills needed to work with SAP S/4HANA Cash Management and Treasury systems. This certification shows you understand how these financial tools work and have the technical knowledge to join project teams. Getting this certification means you’re ready to work on Cash Management and Treasury projects right away. It shows employers that you can make valuable contributions to their teams from day one.

The C_S4FTR_2021 exam is perfect for consultants who want to prove they’re prepared for implementation projects. It helps you get started on projects faster and show you can help make them successful. This certificate is an excellent first step if you want to build a career as a Cash Management and Treasury consultant working with SAP S/4HANA systems. The SAP C_S4FTR_2021 pdf Q&A materials make it easy to prepare and learn at your own pace.

Furthermore Make complex topics easier to understand with C_TS462_2022 Certification, which uses simple explanations and relevant examples to clarify difficult concepts. Explore more about the SAP C_S4FTR_2021 here

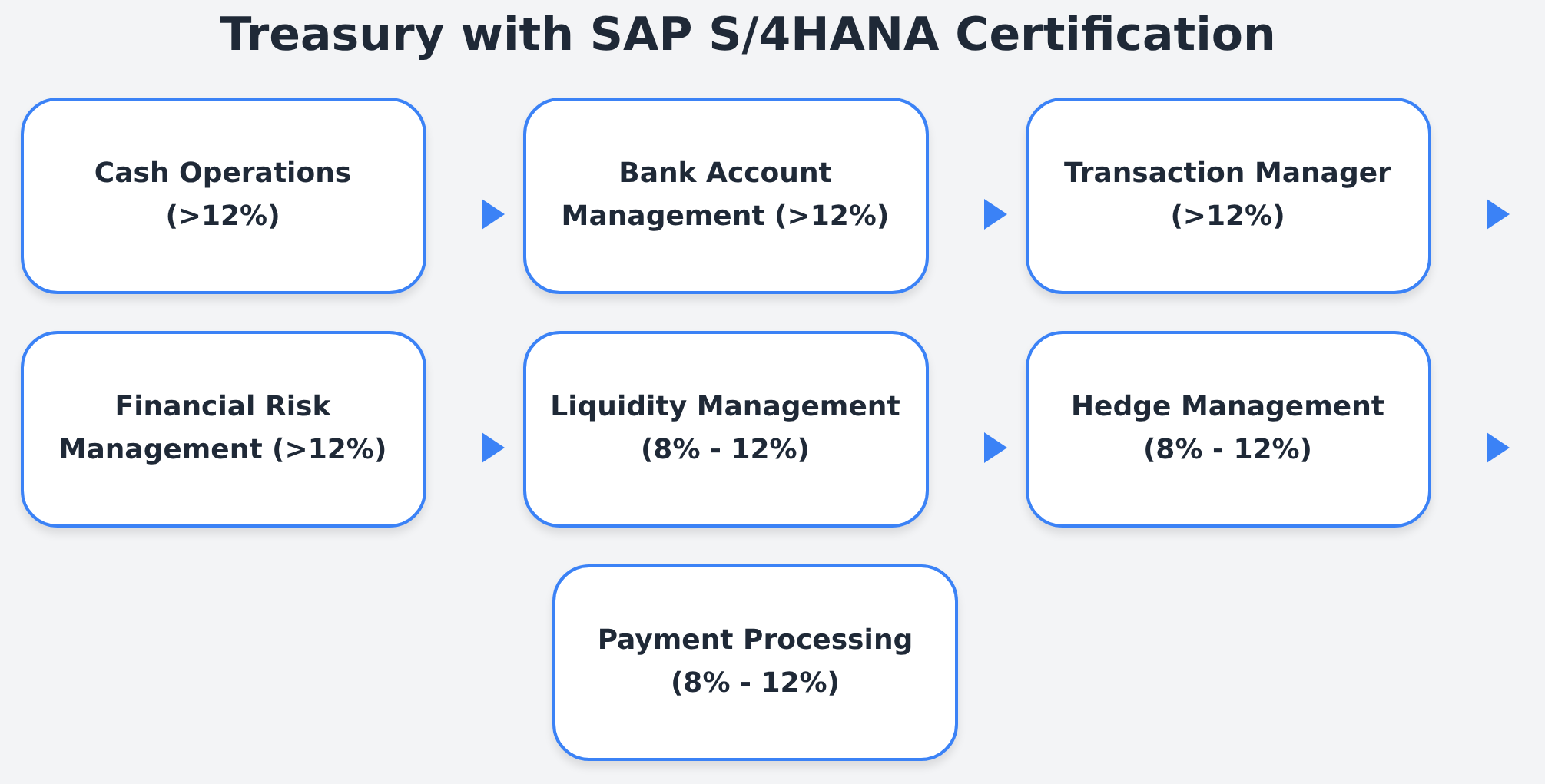

Topics Covered in SAP C_S4FTR_2021 Certification Exam

Below is a simple breakdown of the topics you’ll find in the C_S4FTR_2021 exam for Treasury with SAP S/4HANA. Please note that SAP can change these topics, questions, and their importance at any time.

Cash Operations – More than 12% This section focuses on daily tasks that Cash Managers handle using SAP’s S/4 HANA system. It covers both business processes and system setup from a practical viewpoint.

Bank Account Management – More than 12% Bank Account Management deals with SAP’s central storage system for bank accounts. It also covers the processes used to monitor and manage these accounts within the SAP C_S4FTR_2021 certification scope.

Transaction Manager – More than 12% This topic includes front-office trading activities across all Transaction Manager modules. It also covers back-office tasks and accounting processes like correspondence, interest calculations, and market value assessments.

Financial Risk Management – More than 12% This section tests whether consultants understand both credit risk and market risk analysis tools. The SAP C_S4FTR_2021 pdf materials cover both process knowledge and system configuration skills.

Liquidity Management – 8% to 12% Liquidity Management combines medium to long-term financial planning with actual results tracking and analysis.

Hedge Management – 8% to 12% Hedge management covers exposure management, foreign exchange hedge management, and accounting requirements following IFRS and US GAAP standards.

Payment Processing – 8% to 12% This section covers payment processing options from both Cash Operations and Transaction Manager, including different approval levels and workflows.