C_TS4CO_2021 SAP S/4HANA for Management Certification dumps

Unlock your certification potential with the SAP C_TS4CO_2021 PDF questions and answers. This targeted study resource delivers real exam-style Q&As paired with clear explanations to help you quickly absorb and retain key SAP Management Accounting Made Simple concepts. These authentic C_TS4CO_2021 exam dumps are regularly updated to reflect the current exam content. They concentrate on the high-impact topics that appear on the actual test, making your preparation focused and efficient. Study with confidence and accelerate your path to passing the SAP C_TS4CO_2021 certification.

We offers exact Questions from an actual Exam.

Guaranteed Success in the first attempt.

We'll give you all your money back.

No questions asked.

All orders are Delivered instantly.

Once you will buy any of our products you will be subscribed to free updates for up to 90 days.

We Offers you 24/7 free customer support to make your learning smooth.

$69.00 $95.00

Hurry Up! Offer ends in:

SAP C_TS4CO_2021 – Management Accounting Made Simple Certification

Exam Overview:

- Level: Associate

- Exam: 80 questions

- Delivery Methods: SAP Certification for Exam Preparation (PDF Format)

What This Certification Is About

The SAP C_TS4CO_2021 certification proves you have the basic knowledge and skills needed for SAP S/4HANA Management Accounting. This test checks if you understand the key concepts and can use them in real work situations with help from experienced team members. This certification is perfect for beginners who want to start working on Management Accounting projects. It’s designed as your first step into this field, giving you the foundation you need to succeed.

If you’re looking to become a Management Accounting consultant on SAP S/4HANA, this certificate is an excellent starting point for your career. The C_TS4CO_2021 exam covers all the essential topics you’ll need to know.As you gain more experience working on SAP projects over the years, you can advance your career further. There’s a second, more advanced exam available that focuses on moving from older SAP ERP systems to the newer SAP S/4HANA platform.

This advanced certification is called “SAP Certified Application Professional – Financials in SAP S/4HANA for SAP ERP Financials experts.” It’s designed for professionals who already have solid experience and want to specialize in system migrations.

Furthermore With C_TS4CO_2023 Certification, you can measure your progress effectively, ensuring each study session brings you closer to meeting the certification requirements. For more details about the SAP C_TS4CO_2021

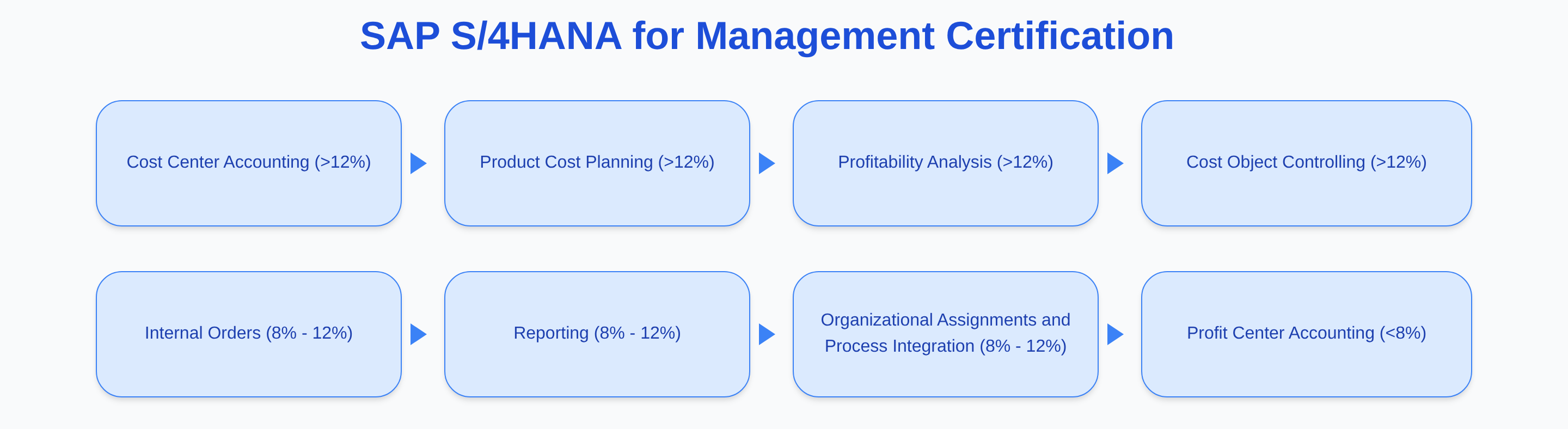

Topic Areas Covered in SAP C_TS4CO_2021 Certification Q&A materials

Below is a list of topics that may appear on this certification exam and the courses that teach them. Please note that SAP can change the exam content (topics, questions, and weightings) at any time, so this information is not guaranteed to be completely accurate.

Cost Center Accounting >12% Learn how to set up and manage cost centers, organize them into groups and hierarchies. You’ll understand how Cost Center Accounting works, including planning features, activity types, and cost center properties. This section also covers planning needs, allocation requirements, and period-end closing processes for Cost Center Accounting (CCA). The SAP C_TS4CO_2021 exam tests your ability to configure these essential accounting functions.

Product Cost Planning >12% Understand how to set up product cost planning and connect it with Profitability Analysis (CO-PA). You’ll learn about different costing versions, cost structures, planning requirements, and multi-level costing methods. This area also covers updating prices in material master records.

Profitability Analysis >12% C_TS4CO_2021 – SAP S/4HANA for Management Accounting Associates certification Set up value fields and characteristics for profitability tracking. Learn about planning, actual data processing, security settings, and reporting authorization for Financial and Controlling data. Configure profitability analysis settings, operating concerns, and period-end closing procedures.

Cost Object Controlling >12% Learn to configure cost object controlling for both planning and actual costs in make-to-stock and make-to-order scenarios. This includes understanding Work in Process (WIP), results analysis, variances, and revenue recognition working with Finance and Sales teams.

Internal Orders 8% – 12% Understand the differences between order categories and types. Learn about planning data, commitments, and actual requirements for internal orders. This section covers creating and configuring internal orders, settlement rules, and period-end closing activities. The C_TS4CO_2021 exam includes questions on internal order accounting concepts.

Reporting 8% – 12% Learn about general reporting needs for cost centers and how to configure cost center reports. You’ll create report painter reports and drill-down reports for better data analysis.

Organizational Assignments and Process Integration 8% – 12% Understand Management Accounting processes across different company codes, including production, sales pricing, inventory management, and transfer pricing. Configure budgeting, availability controls, and period-end closing procedures. Learn about statistical key figures and integration with other SAP modules.

Profit Center Accounting < 8% Create organizational charts for profit centers and understand how Profit Centers work within the General Ledger. Learn to create profit centers, manage master data assignments, and configure period-end closing procedures for Profit Center Accounting (PCA).