C_TS4FI_2023 SAP S/4HANA for Financial Accounting Certification

Prepare smarter with our expertly developed SAP C_TS4FI_2023 PDF questions and answers. These real-exam-based questions are structured for easy understanding and come with detailed explanations to reinforce key SAP S/4HANA Financial Accounting concepts. Our latest C_TS4FI_2023 exam dumps are aligned with the current exam pattern and focus on high-yield topics. With this trusted resource, you can streamline your preparation and confidently aim to pass the SAP certification on your first attempt.

We offers exact Questions from an actual Exam.

Guaranteed Success in the first attempt.

We'll give you all your money back.

No questions asked.

All orders are Delivered instantly.

Once you will buy any of our products you will be subscribed to free updates for up to 90 days.

We Offers you 24/7 free customer support to make your learning smooth.

$79.00 $125.00

Hurry Up! Offer ends in:

C_TS4FI_2023 – SAP S/4HANA Financial Accounting Certification

Exam Overview:

- Level: Associate

- Exam: 80 questions

- Delivery Methods: SAP Certification for Exam Preparation (PDF Format)

What This Certification Is About

The SAP C_TS4FI_2023 certification proves you have the basic skills needed to work with SAP S/4HANA Financial Accounting. This certification shows employers that you understand the key concepts and can handle real-world tasks. This is a beginner-friendly certification perfect for people who want to become Financial Accounting consultants. The C_TS4FI_2023 exam tests your knowledge of essential SAP S/4HANA functions and processes.

We recommend this certification for professionals who have worked on SAP projects before. It’s especially useful if you plan to work with SAP S/4HANA Cloud Private Edition or SAP S/4HANA on-premise systems. Getting certified helps you stand out in the job market and proves you’re ready to handle Financial Accounting tasks in SAP S/4HANA environments.

Furthermore Accelerate your learning with P_S4FIN_2023 Certification, designed to fit into your schedule and help you study efficiently without sacrificing quality. Visit the official page for SAP C_TS4FI_2023

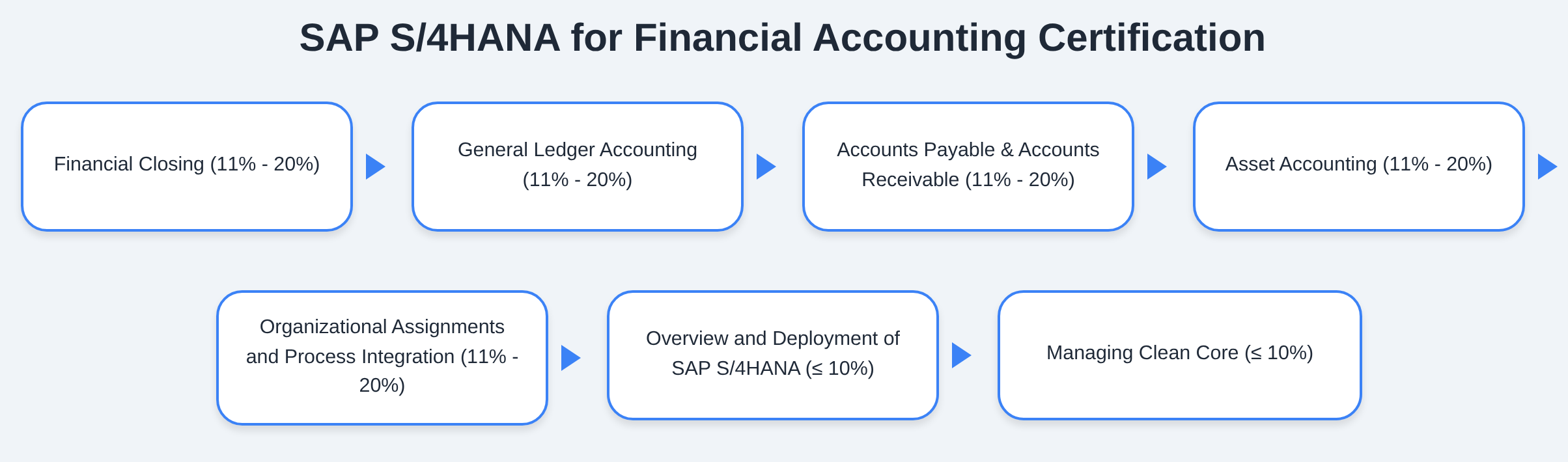

Topics Covered in the SAP C_TS4FI_2023 Certification Q&A materials

Here’s a simple breakdown of the topics you’ll find in the SAP C_TS4FI_2023 certification materials. Keep in mind that SAP can change the exam content, topics, and weightings at any time, so this list is just a guide.

Financial Closing 11% – 20% Learn how to close the books at month-end and year-end. This includes tasks like updating currency exchange rates, creating balance sheets and profit/loss statements, managing accruals, and controlling closing activities through the Financial Closing Cockpit. You’ll also learn how to handle posting periods effectively.

General Ledger Accounting 11% – 20% Master the basics of setting up and managing general ledger accounts, exchange rates, and bank information. The SAP C_TS4FI_2023 exam covers how to create and reverse postings, handle transactions between different company codes, set up profit centers, and work with document splitting features.

Accounts Payable & Accounts Receivable 11% – 20% This section teaches you how to manage customer and vendor relationships. You’ll learn to create business partner records, process invoices and payments, handle special transactions, set up automatic payment programs, and manage partial payments and payment blocks.

Asset Accounting 11% – 20% Get hands-on experience with managing company assets in SAP. This includes setting up depreciation methods, creating asset master data, handling asset transactions, and performing year-end closing procedures. You’ll also learn about parallel accounting methods.

Organizational Setup and Process Integration 11% – 20% Learn how to set up the organizational structure in SAP, manage different currencies, create validation rules, configure document types, use reporting tools, and set up automatic substitutions and number ranges.

SAP S/4HANA Overview and Setup Options <= 10% Understand the technical foundation of SAP HANA and explore the different ways to deploy SAP S/4HANA in your organization. This section provides the background knowledge you need for the SAP C_TS4FI_2023 pdf Q&A materials.

Managing Clean Core <= 10% Discover how to keep your SAP system clean and efficient. This topic covers best practices for maintaining system flexibility, reducing customization complexity, and speeding up future updates and innovations.